Lumen technologies dividend driver#

The biggest growth driver for Lumen would come from acquisitions and mergers. This represented an increase of 26.5% year-over-year growth.

Lumen technologies dividend full#

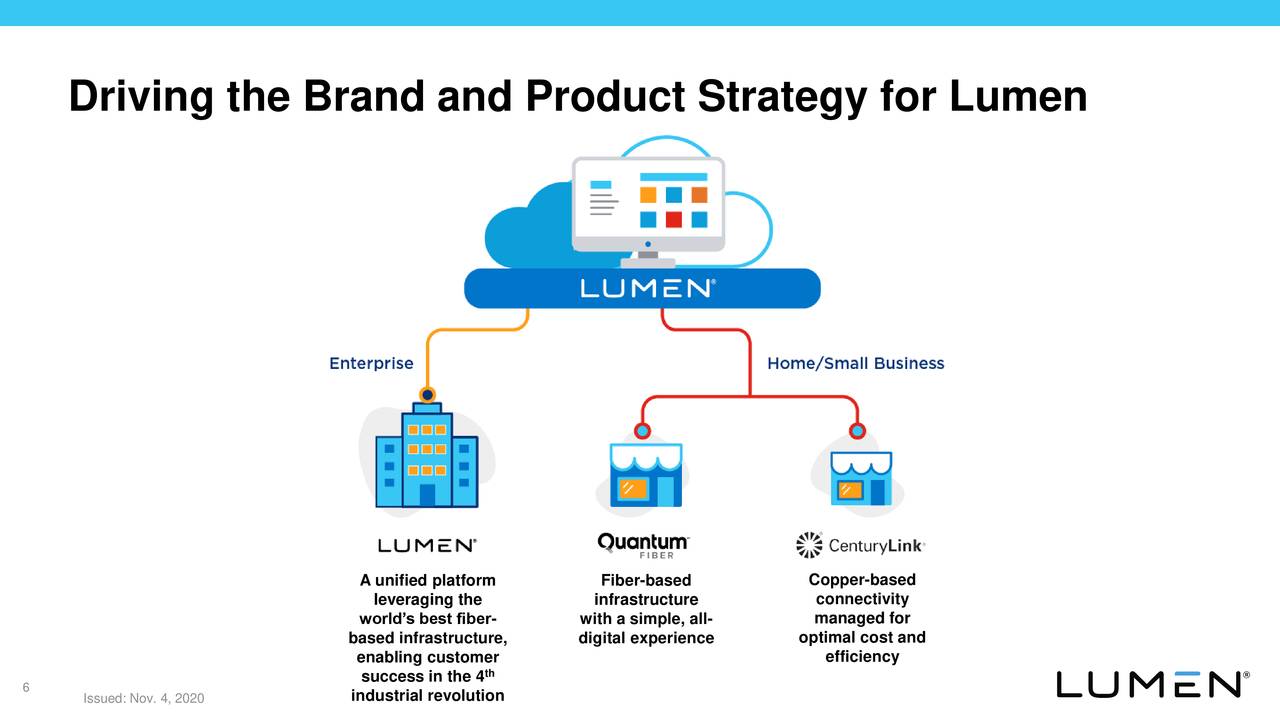

Net income for the year was $2,033 million versus a net loss of $1,232 million in FY 2020.įor the year, EPS reported $1.91 per share for 2021, compared to $1.51 per share for the full year 2020. However, the company did make a profit last year compared to a net loss for 2020. This was lower than the $20,712 million the company reported in FY 2020, a decrease of 4.9%. Overall for the quarter, the company had adjusted earnings per share (EPS) of $0.51 was a 21.4% increase over $0.42 earned in the same prior-year period.įor the full year, the total revenue was $19,687 million. Net income was much better than 4Q2021.įor the quarter, net income was $508 million, compared to a reported net loss of $2.289 billion for the fourth quarter of 2020. The company reported total sales for the quarter of $4,847 million compared to total sales of $5,125 million, which is a decrease of 5.4% year-over-year. The company reported fourth-quarter and full-year results for Fiscal Year (FY) 2021 on February 9th, 2022. The company is designed specifically to address the dynamic data and application needs of the 4th Industrial Revolution. Lumen brings together the talent, experience, infrastructure, and capabilities of CenturyLink, Level 3, and 25+ other technology companies to create Lumen Technologies, Inc.

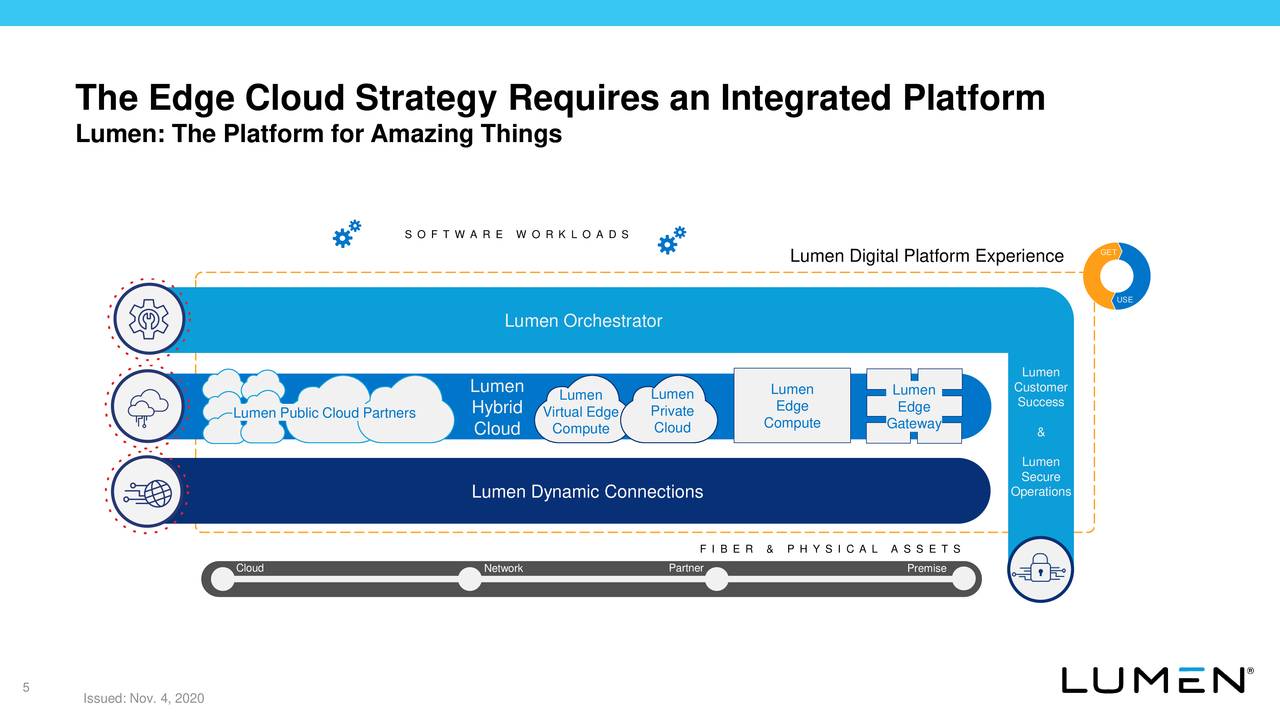

The company integrates network assets, cloud connectivity, security solutions, voice, and collaboration tools into one platform that enables businesses to leverage their data and adopt next-generation technologies. The name Lumen was brought about in September 2020 to rebrand and reposition the company as a critical partner in leading enterprises through the 4th Industrial Revolution – or the smart technology revolution. It has an $11.4 billion market capitalization and produced $19.7 billion in revenue in 2021. They would eventually expand exponentially into what has become Lumen, which serves customers in over 60 different countries today. Lumen Technologies traces its roots to 1930 when the Oak Ridge Telephone Company was purchased by the Williams family. (LUMN), which currently has a dividend yield of 9.3%.

Click here to download your free spreadsheet of all high dividend stocks now.įor the next high-yield stocks in this series, we will review a multinational technology company Lumen Technologies, Inc.

0 kommentar(er)

0 kommentar(er)